36+ Mortgage calculator with pmi and hoa

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. The Math Behind Our Mortgage Calculator.

Mortgage Comparison Spreadsheet Mortgage Comparison Refinance Mortgage Mortgage

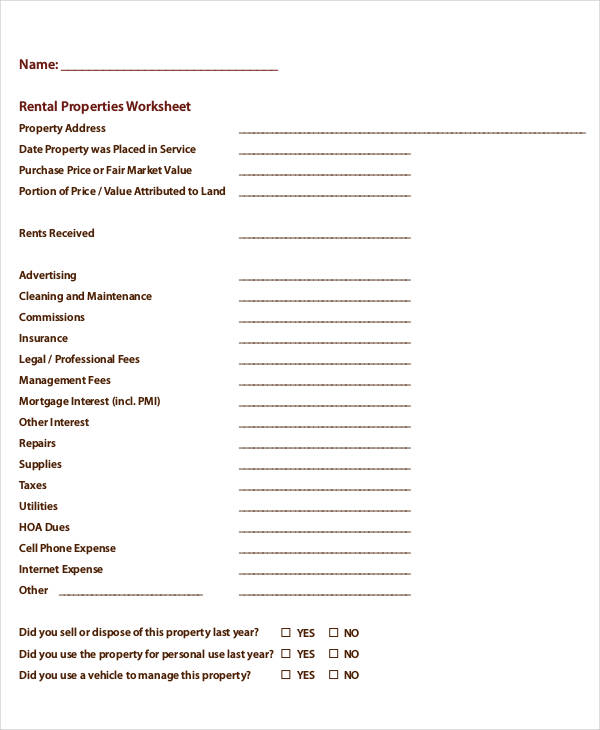

Mortgage insuranceIf your down payment is less than 20 of the cost of your house many lenders will require you to pay an additional fee called.

. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. After the initial introductory period the loan shifts from acting like a fixed-rate mortgage to behaving like an adjustable-rate mortgage where rates are allowed to float or reset each year. Whoathose are a.

This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage. Use Moneys free mortgage calculator to get an estimated monthly mortgage payment based on your loan details. Across the United States 88 of home buyers finance their purchases with a mortgage.

Private mortgage insurance PMI is separate from homeowners insurance if you input a down payment of under 20 in our calculator youll have a PMI estimate as well. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. Use this free California Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

M Monthly Payment. We also publish current Boydton conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs. This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees.

Depending on the home you may also have condo association or homeowners association HOAdues though these are paid separately from your monthly mortgage bill. It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Across the United States 88 of home buyers finance their purchases with a mortgage. Beneath the mortgage rate table we offer an in-depth guide comparing conforming. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. If you would like to calculate all-in payments with other factors like PMI homeowners insurance property taxes points HOA fees please use our advanced calculator. Use this free tool to figure your monthly payments for a given loan amount.

Using the FHA Mortgage Calculator. How to Use the Mortgage Calculator. Principal includes UFMIP.

Lenders look most favorably on debt-to-income. See how changes affect your monthly payment. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Monthly Principal Interest Payment. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. Its popularity is due to low monthly payments and upfront costs.

Putting 20 down lets you avoid paying for private mortgage insurance PMI. The Freddie Mac Primary Mortgage Market Survey for October 8 2020 stated the average 30-year fixed-rate mortgage charges 287 with 08 fees points. If you pay for the points upfront with other closing costs and put 20 down on a home priced at the 2019 average you would need to save 76780 while obtaining a loan for 307120.

This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. HOA Fees Monthly - some. Down Payment One-time Expenses.

Use this free New York Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

That means your mortgage payment should be a maximum of 1120 28 percent of 4000 and your other debts should add up to no more than 1440 each month 36 percent of. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments. If a loan is named a 51 ARM then what that means is the loan is fixed for the first 5 years then the rate resets each year thereafter.

Property taxes home insurance PMI and dont forget to consider HOA fees. Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total debt. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Most people need a mortgage to finance a home purchase. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations.

Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. If you use our mortgage calculator and plug in a home value of 198000 with a 20 down payment at a 5 interest rate youll find that your maximum monthly payment of 1250 jumps to 1506 when you add in 182 for taxes and 71 for insurance. This fee is only required for a limited period and is removed once.

As a basic calculator it quickly figures the principal interest payments on a fixed-rate loan. Similar to Private Mortgage Insurance PMI with Conventional Loans based on loan-to-value LTV your credit score amortization period refinance or purchase etc. PMI is typically included in monthly mortgage payments which may cost anywhere between 025 to 2 of your loan per year.

Show amortization schedule. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. 15 Year Fixed Rate Mortgage Calculator.

30-Year Mortgages and Extra Payments. P Principal Amount initial loan balance i Interest Rate. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Expense Report 36 Examples Samples Pdf Google Docs Pages Doc Examples

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Ana Rosa Valentines Gift Guide What Dreams May Come Beautiful Friend

How Can You Efficiently Use Hdfc Personal Loan Calculator Personal Loans Amortization Schedule Loan Calculator

Financial Advisor Business Plan Template Lovely Create A Business Plan In Excel Personal Financial Planning Financial Plan Template Business Plan Template Free

Pin On Tithes

Commercial Loan Amortization Schedule How To Create A Commercial Loan Amortization Schedule Download This Co Amortization Schedule Schedule Commercial Loans

9 Hidden Costs That Come With Buying A Home Buying First Home Buying Your First Home First Home Buyer

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Millennial First Time Home Buyer Starter Pack First Time Home Buyers Millennials Home Buying

Fabelhaft Excel Kalkulationstabelle Vorlage Galerie Amortization Schedule Excel Spreadsheets Templates Mortgage Repayment Calculator

Expense Report 36 Examples Samples Pdf Google Docs Pages Doc Examples

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

8516n Hilltop Road Hayward Wi 54843 Mls 1567147 Edina Realty

Mortgage Payoff Watches Mortgage Payoff Mortgage Interest Rates Refinancing Mortgage

Mortgage Calculator