44+ Hope'S Contribution To Her Retirement Plan

Web These contributions should fund annual retirement checks beginning with 50000 on her 65th birthday. Hope actually received her pay on the last day of her pay period.

Doral Chamber Of Commerce Miami S Best Chamber

Web Defined contribution retirement plans are the most prevalent type of employer-sponsored retirement benefit in todays economy.

. MrsMcNamara just turned 44 and is beginning to plan for her. Hopes net pay was 600 for this pay period. Is a post-tax contribution on which she pays federal income taxes b.

For 2021 the maximum compensation used for figuring contributions and benefits is 290000. Is pre-tax and therefore not. McNamara just turned 44 and is beginning to plan for her.

Web Hope College Invest Plan 4 Important Information About the Plan Plan Sponsor. Since this person earns 1000 the maximum. Hopes contribution to her RETIREMENT plan.

Web The Elective Deferral Limit For Simple Plans Is 100 Of Compensation Or 13500 In 2020 2021 And 2022 13000 In 2019 And 12500 In 2018. Retirement contributions can be pretax or after tax depending on whether the. A monetary contribution to a retirement plan.

Web Retirement Contribution. Is pre-tax and therefore not included in federal income. For the year 2020 the maximum individual contribution to an IRA is the lesser of 100 of income or 6000.

Web The elective deferral limit for SIMPLE plans is 100 of compensation or 15500 in 2023 14000 in 2022 and 13500 in 2020 and 2021. Those aged 35 to 44 and older often struggle to save for retirement while juggling financial responsibility for children and aging parents. Web Key Takeaways.

Web Your target savings rate includes any contributions your employer makes to a retirement savings plan for you such as an employer matching contribution. Is a post-tax contribution on which she pays federal income taxes b. This limit increases to 305000 for.

Hopes net pay for this pay period was 28479. Web These contributions should fund annual retirement checks beginning with 50000 on her 65th birthday. Hopes contribution to her RETIREMENT plan.

Web Compensation limits for 2021 and 2022. Hope College Employer 100 East 8th Street Suite 210 Holland MI 49423 616-395-7811 EIN. In 2016 44 percent of.

Hope S Contribution To Her Retirement Plan A Is A Post Tax Contribution On Which She Pays Brainly Com

Amp Pinterest In Action Retirement Speech Speech Ms Word

Retirement Letter 22 Examples Format Sample Examples

Mount Hope Solar Panel Installation Makello

2018 Black Book 364 Executives To Know Hawaii Business Magazine

Pdf Web Communities Immigration And Social Capital Jasmina Maric Academia Edu

How Does My Pension Work In Retirement

Agenda Of Monitoring And Operations Committee Tuesday 8 March 2022

They Don T Know Small Regina 9781734100402 Amazon Com Books

Doc Lifelong Learning Policy Paper Turkey Doc Derya Buyuktanir Academia Edu

Listen To Valiant Growth Podcast Deezer

Wealthica Archives Journey To 100b Wealthica

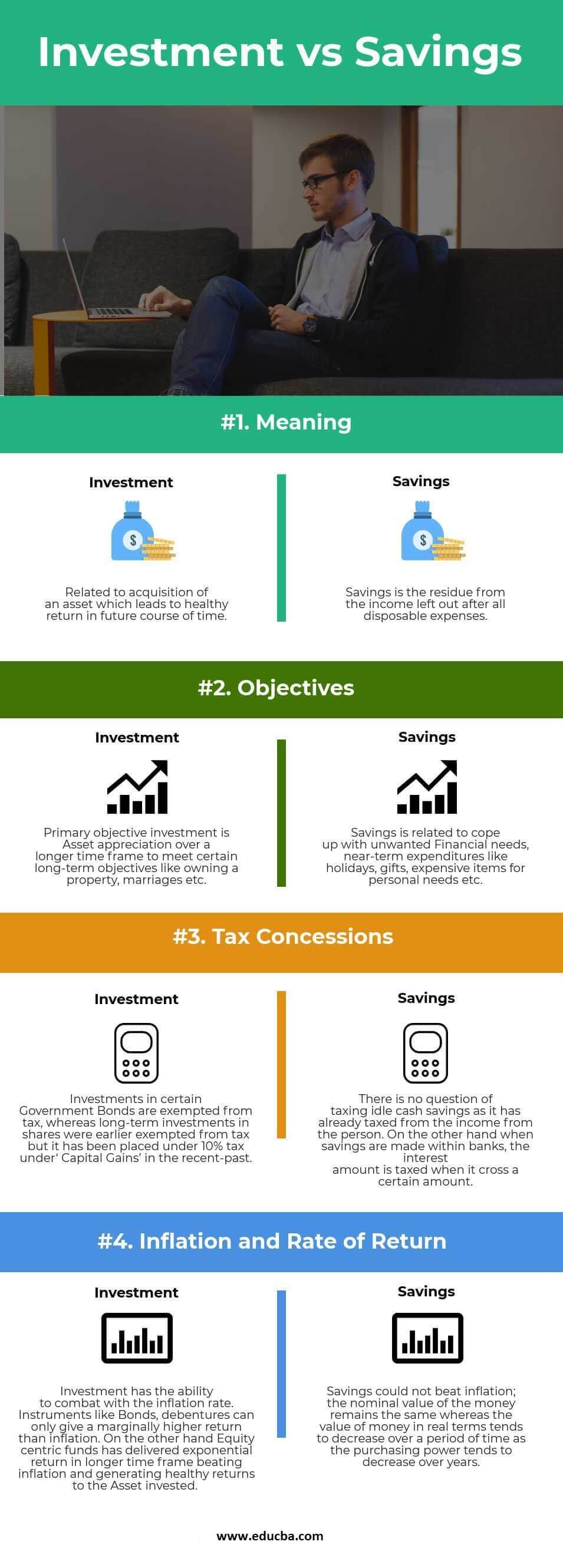

Investment Vs Savings Learning The Top Key Differenecs And Comparison

Pdca Lessons Learned

No More Relationships With Girls Next Door After Two In The Priory Street Posse

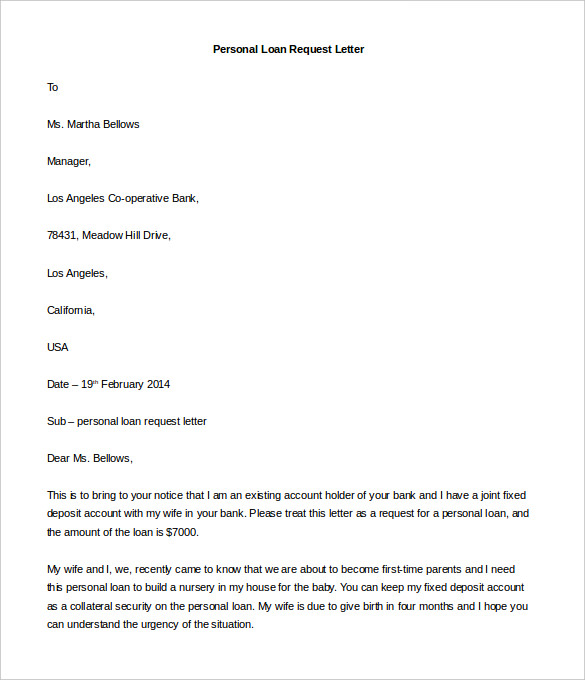

44 Personal Letter Templates Pdf Doc

In Cricket Do Players Gain A Benefit By Usually Playing The Same Outfield Position This Relates To Whether Players Get In A Groove Catching In A Certain Position E G Second Slip Cook S